Introduction

Outline

These legacy pages provided a source of information leadning up to the University of Cambridge ballot on the 2010/11 changes to the Universities Superannuation Scheme (USS), and more generally on the official USS consultation for those changes.

Why should you be interested in these pages?

I would encourage you to read on because changes to the USS pension scheme are in-train that will probably cost

- current members of USS tens of thousands of pounds;

- staff joining USS after 1 April 2011, or current members of USS rejoining after 1 April 2011 (e.g. after a period of employment abroad), hundreds of thousands of pounds.

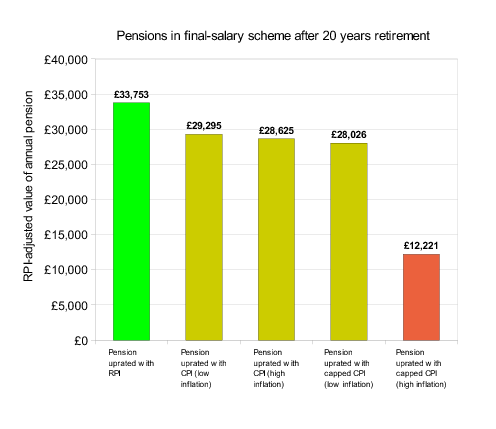

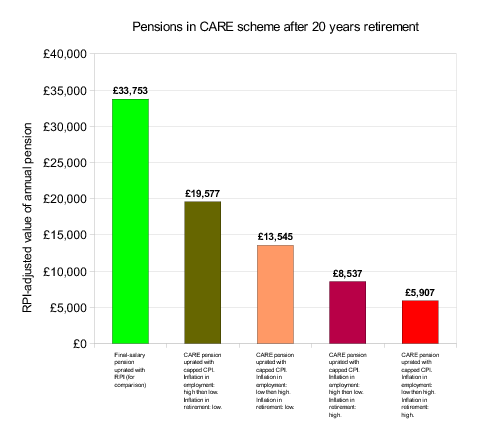

The graphs to the right illustrate a possible change to your pension after 20 years of retirement (click on one of them for an explanation and larger graphs). The green bar is what you would receive with the current final-salary scheme and with a pension uprated by the Retail Price Index (RPI).

The top graph applies to members in the current final-salary scheme. The orange bar is what your pension might be worth after a 20-period of 1970s/1980s style high inflation during retirement. The bottom graph applies to future members of the proposed CARE scheme. The red bar is what your pension might be worth after two 20-year periods of high inflation and one 20-year period of low inflation during employment and retirement.

Articles

The reason that these pages are advertised as part of the Cambridge ballot is because of the article, What do the USS pension changes mean?, that Susan Cooper and I wrote for the Oxford Magazine (No. 305). The article reviews the proposals and attempts to illustrate some of the changes. If you do nothing else before filling in your ballot then I would encourage you to read that article (since a number of people have been kind enough to say that our explanations are clearer than those on the official USS consultation website).

In response to our article the employers commissioned a reply by Peter Thompson, Reforming USS – the case for change, that appeared in the next edition of the Oxford Magazine (No. 306). This edition also includes a second article by Susan Cooper, Sustainability and the USS Pension.

Conclusions I draw from the above articles include:

- the employers sums do not seem to add up, and that in the short term there would appear to be no need for such significant cuts in pension provision as proposed;

- a restructuring of the pension scheme may be needed for long-term sustainability and fairness, but the proposals do not achieve that;

- the employers have been economical with the truth (if you still need convincing read the page on whether the employers' real aim is to reduce their contribution to USS to 10%).

Further Information

The aforementioned articles and these pages arose from efforts I was making in Cambridge to draw the attention of both the Council and members of the wider University to the inadequate consultation by USS on our pensions; for more information on this see the Cambridge developments page.

At present there is also

- a media page with links to articles on the USS proposals and more general changes to pensions;

- a links page that references other summaries of the changes, source material that Susan and I used for our article, etc.

In due course I hope that there will a page that can be used to make intelligent responses to the USS consultation.